Blockchain Layers Explained: How Blockchain Works

In this article, I will walk through the main blockchain layers: Layer 0, Layer 1, Layer 2, and Layer 3 using that city analogy as a guide. The goal is to show how these layers interact, why they exist, and how they help blockchains scale without giving up security or decentralization.

#What are blockchain layers?

Blockchain ecosystems are often described in “layers.” You will hear references to Layer 1, Layer 2, sometimes Layer 3, and increasingly Layer 0. All of these terms try to capture how blockchain networks are structured and how different components work together to deliver security, decentralization, and scalability.

A useful way to think about this is to imagine the blockchain world as a digital city:

-

A solid foundation that everything else relies on

-

High-speed highways built above it

-

Skyscrapers where people live, work, and interact

-

And the invisible infrastructure that connects entire cities together

#How many layers in blockchain?

There are 3 core layers, but you’ll often hear people talk about a 4-layer stack (including layer Layer 0) in practice.

3 core technical layers (inside a single blockchain):

- Network layer – how nodes talk to each other

- Consensus layer – how they agree on the ledger state

- Application layer – smart contracts, dApps, user logic

Or, as explained in this guide:

4 ecosystem layers (L0–L3):

- Layer 0: Underlying network / interoperability (e.g. Polkadot, Cosmos)

- Layer 1: Base blockchain (e.g. Bitcoin, Ethereum mainnet)

- Layer 2: Scaling/rollups and off-chain solutions

- Layer 3: Application / dApp layer

Watch a short video overview of how blockchain layers work:

#The Problem: Blockchain’s Trilemma

To understand why layers are needed, it helps to start from the underlying problem they are trying to solve.

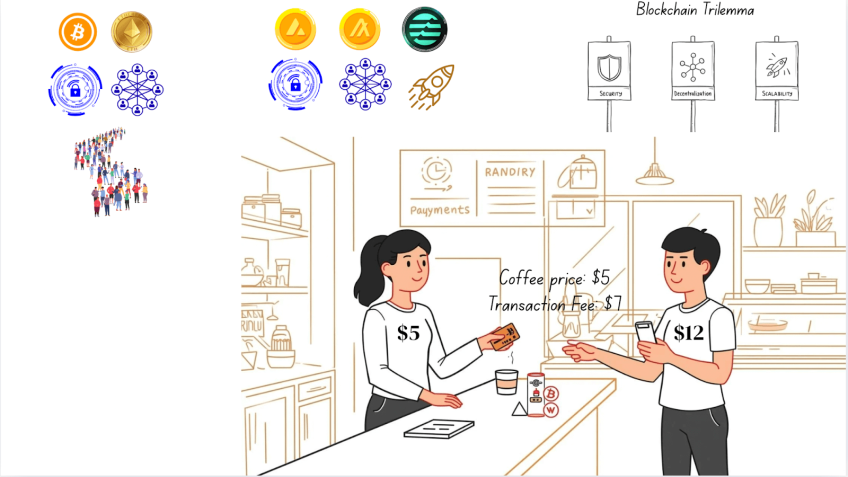

Consider a simple example: buying a coffee with Bitcoin. The coffee costs $5. The transaction fee is $7. On top of that, you may wait around ten minutes for the transaction to confirm. Meanwhile, someone paying with a contactless card taps once and is done.

This is not a temporary glitch; it is a symptom of a deeper constraint often called the blockchain trilemma. Every blockchain has to balance three core properties:

-

Security – how resistant the network is to attacks and fraud

-

Decentralization – how widely distributed validation and control are

-

Scalability – how many transactions the network can process quickly and cheaply

In practice, it is very difficult to maximize all three at once.

Bitcoin and Ethereum chose to prioritize security and decentralization. That is why they are trusted and resilient, but also why they can become congested and expensive to use under load. Newer blockchains such as Algorand, Avalanche, and Aptos are exploring designs that achieve higher throughput without abandoning security or decentralization, but this was not possible in the early generations of blockchain networks.

Engineers therefore began to explore a different idea: instead of forcing one layer to handle everything from consensus, execution, data availability, and user experience, what if responsibilities were split across multiple layers, each optimized for a specific role?

The rest of the article builds on that idea. We start from the interoperability and infrastructure backbone often referred to as Layer 0, then move up through Layer 1 (base chains), Layer 2 (scaling layers), and Layer 3 (applications), showing how they fit together into a coherent “digital city.”

#Layer 0: The Infrastructure and Interoperability Backbone

Before looking at the base blockchains themselves, it is useful to mention what is often called Layer 0. Despite the name, Layer 0 should not be thought of as something “underneath” Bitcoin or Ethereum in a chronological sense. Those base chains came first historically.

Instead, Layer 0 describes the infrastructure and frameworks that newer blockchains use to launch and connect networks. It functions as an internet backbone for blockchains, enabling multiple chains to be created and to communicate with each other.

Prominent examples include:

-

Cosmos and its ecosystem of zones

-

Polkadot and its relay chain with parachains

-

Avalanche and its subnets

These platforms provide base technology that allows developers to:

-

Launch new, application-specific blockchains

-

Inherit security or coordination from a shared framework

-

Enable communication between otherwise separate ecosystems

Typical Layer 0 responsibilities include:

-

Sidechains and parachains – independent chains that connect to a central hub or relay

-

Cross-chain transfer protocols, such as Cosmos’ IBC (Inter-Blockchain Communication), which standardises how chains send data and assets between each other

-

Oracles, which bring real-world data (prices, events) into blockchain environments

-

Bridges, which move assets across chains and networks

In the Avalanche ecosystem, for example, subnets can evolve how validators coordinate, and proposals such as ACP-77 aim to improve how these subnet validators scale and interoperate over time. This illustrates how Layer 0 is less about a single chain and more about the coordination layer for many chains.

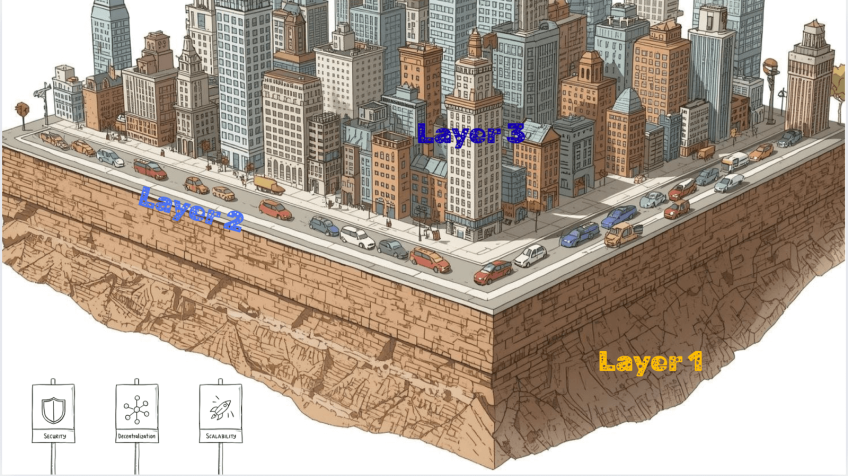

Returning to the digital city analogy:

Layer 0 is comparable to the fiber optic cables and backbone links between cities—mostly invisible to end users, but essential for connecting separate blockchain ecosystems into a broader network.

With Layer 0 in place as the connectivity and infrastructure layer, we can move up one step in the stack to the base chains themselves: Layer 1.

#Layer 1: Base Blockchains and Consensus

If Layer 0 is the connectivity backbone, Layer 1 is where the blockchain itself starts. In the digital city analogy, Layer 1 is the foundation slab: the base layer on which everything else is built.

A Layer 1 blockchain is the raw chain with its own consensus rules, validator set or miners, and native assets. This is where:

-

Transactions are recorded permanently

-

State is updated and verified

-

Security and trust are anchored

#What Layer 1 Blockchains Do

At Layer 1, the primary concerns are:

-

Consensus – ensuring that all participating nodes agree on a single, canonical history

-

Security – protecting that history against attacks and manipulation

Bitcoin is the simplest example of a Layer 1. It acts as a secure, append-only ledger for transferring value. The focus is narrow, but the guarantees are strong.

Ethereum extended this idea by introducing smart contracts programmable logic that can hold assets, enforce rules, and power entire application ecosystems. This opened the door to decentralised finance, on-chain gaming, NFTs, DAOs, and more.

Other Layer 1 networks such as Solana, Avalanche, and Algorand were designed to address the blockchain trilemma more directly. They aim to be secure and decentralised while also supporting higher throughput and lower fees, using alternative consensus mechanisms and architectures.

Set up your Solana server in minutes

Optimize cost and performance with a pre-configured or custom dedicated bare metal server for blockchain workloads. High uptime, instant 24/7 support, pay in crypto.

#Consensus Mechanisms and Their Trade-offs

The core of a Layer 1 chain is its consensus mechanism, the set of rules and processes that allow thousands of distributed computers to agree on “one version of the truth”.

Common examples include:

-

Proof of Work (PoW), used by Bitcoin, where miners expend computational effort to propose blocks.

-

Proof of Stake (PoS), now used by Ethereum, where validators stake tokens and are rewarded or penalised based on their behaviour.

These mechanisms are designed to make it extremely expensive to attack the network or rewrite history, which is why mature Layer 1 systems are considered highly secure and resilient. However, this comes with limitations in:

-

Throughput – only a limited number of transactions can be processed per block

-

Latency and fees – during high demand, users compete for block space, driving fees up and slowing confirmations down

A well-known example is Ethereum during the CryptoKitties period in 2017, when a single popular application significantly congested the network. Transaction fees spiked to tens of dollars, and simple interactions became noticeably slower.

This illustrates a key point:

Layer 1 is essential as the bedrock of trust, but on its own it struggles to support mass adoption and high-frequency usage.

To address this limitation without weakening the security model of the base chain, the ecosystem turned to the next layer in the stack: Layer 2.

#Layer 2: Scaling on Top of the Base Chain

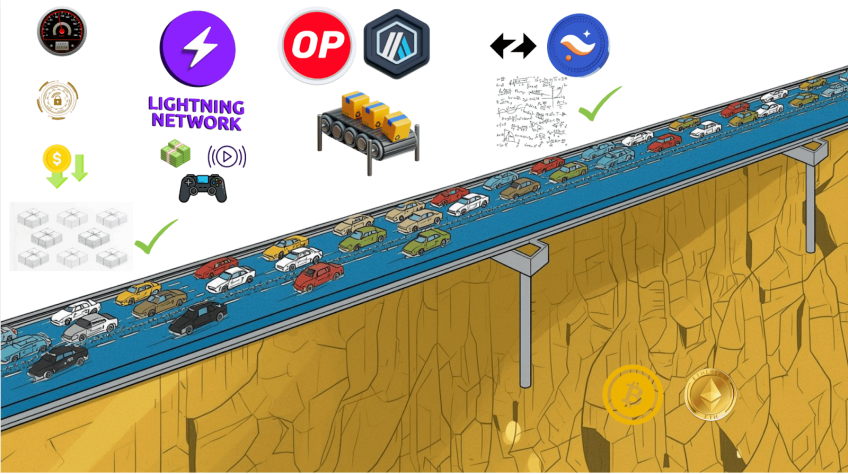

If Layer 1 is the foundation of the blockchain “city”, Layer 2 is the highway system built above it. It does not replace the foundation. Instead, it is designed to relieve pressure from the base chain.

The key idea behind Layer 2 is straightforward:

Instead of asking the Layer 1 blockchain to process every single transaction directly, move most activity off-chain or into a separate environment, then periodically settle the result back on the base layer.

This approach allows Layer 1 to continue focusing on security and decentralization, while Layer 2 solutions provide additional speed and cost efficiency.

In practice, Layer 2 solutions typically:

-

Execute or aggregate many transactions off-chain

-

Bundle or compress them into a single update

-

Post that update, along with proofs or fraud-detection mechanisms, back to the Layer 1 chain

The result is that users retain the security guarantees of the base chain, but enjoy lower fees and faster confirmations.

#Example: Bitcoin’s Lightning Network

On Bitcoin, the most prominent Layer 2 solution is the Lightning Network.

Lightning works by allowing participants to open payment channels:

-

A user and a counterparty lock some BTC into a channel via an on-chain transaction.

-

They can then send funds back and forth off-chain, updating their balances instantly and at very low cost.

-

Only when they decide to close the channel is a final transaction settled back on the Bitcoin blockchain.

This pattern is well-suited to:

-

Micropayments and streaming payments

-

High-frequency, low-value transactions

-

Everyday usage scenarios like small purchases or in-app payments

Bitcoin remains the security anchor, while Lightning provides the user experience that a base layer alone cannot efficiently deliver.

#Example: Ethereum Rollups

On Ethereum, the dominant Layer 2 approach today is based on rollups.

Rollups execute transactions off the main Ethereum chain, then batch and submit them back to Ethereum in a compact form. There are two main categories:

-

Optimistic rollups (such as Arbitrum and Optimism)

-

Assume transactions are valid by default.

-

Include a mechanism for other participants to challenge fraudulent transactions during a dispute window.

-

-

Zero-knowledge (ZK) rollups (such as zkSync and Starknet)

-

Use advanced cryptographic proofs to show that a batch of transactions is valid.

-

The proof is posted on-chain and can be verified efficiently by the Layer 1.

-

In both models, users transact on the Layer 2 environment, while Ethereum acts as the final settlement layer and security anchor.

The impact on scalability is significant:

-

A rollup can bundle hundreds or thousands of transactions into a single update.

-

The amount of data posted to Ethereum per transaction is reduced.

-

Overall throughput increases dramatically, and average transaction fees fall from dollars to fractions of a cent.

From a user perspective, this means that a large share of activity that is considered “Ethereum usage” now actually occurs on its Layer 2 ecosystems rather than directly on the Layer 1 chain.

#Layer 3: The Application Layer

While Layer 1 and Layer 2 focus on security, consensus, and scalability, users primarily experience blockchain through applications. This is what is often referred to as Layer 3: the application layer.

In the digital city analogy, if Layer 1 is the foundation and Layer 2 is the highway system, then Layer 3 is the city itself, the places where people actually live, work, and interact.

Layer 3 is where blockchain infrastructure becomes:

-

Discoverable

-

Usable

-

Integrated into real products and services

#What Lives at Layer 3

Layer 3 covers a broad range of application-specific environments and stacks that build on top of Layer 2 or Layer 1:

-

Gaming-focused layers and app chains, such as Immutable X on Ethereum

-

Specialised trading environments, such as dYdX, which runs its own chain for derivatives trading

-

Custom rollups and application-specific chains, enabled by frameworks like Arbitrum Orbit, which let developers create rollups tailored to a particular use case

From an end-user perspective, Layer 3 is where most interaction with “blockchain” actually happens. Typical examples include:

-

Playing a blockchain-based game

-

Trading on a decentralised exchange

-

Minting or trading NFTs

-

Participating in a DAO or governance process

-

Using decentralised social or identity applications

In these scenarios, users are not thinking in terms of consensus mechanisms, data availability strategies, or rollup architectures. They interact with:

-

Web interfaces and wallets

-

APIs and SDKs

-

Application-specific flows and abstractions

The underlying complexity of Layers 0, 1, and 2 is deliberately hidden.

#Relationship to Lower Layers

Although Layer 3 is closest to users, it is tightly coupled to the lower layers:

-

Most Layer 3 applications execute transactions on a Layer 2 environment to benefit from low fees and high throughput.

-

Those Layer 2 environments, in turn, rely on a Layer 1 chain for final settlement and security.

-

Layer 0 technologies provide connectivity and interoperability when applications need to bridge assets or data across multiple ecosystems.

In practice, a Layer 3 application might:

-

Run its logic and state transitions on a custom rollup or app chain (L2 or L3 terminology can overlap here).

-

Periodically settle state or proofs back to Ethereum or another Layer 1 chain.

-

Use Layer 0 protocols or bridges to move assets between chains or interact with other ecosystems.

This layered structure allows application developers to focus on product design and user experience, while inheriting security and scalability from the lower layers.

Nice, let’s stitch the layers together.

#How the Layers Work Together

So far, each layer has been described in isolation. In practice, they form a stack that applications use end-to-end.

A typical path looks like this:

-

A user interacts with an application at Layer 3 – for example, a DeFi protocol, a trading platform, a game, or a social app.

-

The application submits transactions to a Layer 2 environment, such as a rollup, to benefit from lower fees and higher throughput.

-

The Layer 2 system periodically reports back to a Layer 1 blockchain, which acts as the final settlement layer.

-

Layer 0 protocols and bridges provide connectivity when the application needs to move assets or data across different ecosystems.

DeFi is a good example. Protocols such as Uniswap, Curve, and Aave depend on this layered stack:

-

The application logic and user interfaces sit at Layer 3.

-

A large part of the transaction processing increasingly happens on Layer 2 rollups, where operations are cheaper and faster.

-

Final settlement and security are still anchored on a Layer 1 chain like Ethereum.

The same pattern applies to other categories:

-

Gaming applications use Layer 2 or specialised app chains to keep gameplay responsive and transaction costs low.

-

NFT platforms rely on scaling layers to handle minting, transfers, and marketplace activity without pricing out users.

-

Social and governance tools use the stack to provide low-friction interactions while preserving verifiable, on-chain records when needed.

Each layer contributes a distinct capability:

-

Layer 1 provides security and a neutral, verifiable base ledger.

-

Layer 2 adds scalability and cost efficiency, allowing many more transactions to be processed.

-

Layer 3 focuses on usability and domain-specific functionality.

-

Layer 0 connects different ecosystems and makes it possible for assets and data to move between them.

Viewed together, these layers are a coordinated response to the blockchain trilemma. No single layer fully solves the trade-off between security, decentralization, and scalability on its own. Instead, the combination of layers allows systems to approach all three goals more effectively than a monolithic design.

#Conclusion

We started with the simple example of an expensive coffee purchase on a congested blockchain and arrived at a layered digital city.

-

Layer 1 provides the trust foundation: a secure, decentralised ledger where transactions are recorded and finalised.

-

Layer 2 adds scalability: offloading work from the base chain, aggregating transactions, and significantly reducing costs and latency.

-

Layer 3 delivers real-world applications: the environments where users actually interact with financial protocols, games, NFTs, governance systems, and other services.

-

Layer 0 acts as the internet backbone: the hubs, bridges, and interoperability frameworks that connect entire blockchain ecosystems. Cosmos uses IBC, Polkadot connects parachains through its relay chain, and Avalanche relies on subnets that continue to evolve through proposals such as ACP-77.

Together, these layers form a coherent response to the blockchain trilemma. Instead of expecting a single monolithic chain to maximise security, decentralisation, and scalability at once, responsibilities are distributed: base layers specialise in security and consensus, while upper layers focus on throughput, usability, and cross-chain connectivity.

Although Bitcoin and Ethereum are the most prominent examples discussed here, they are not alone. Other Layer 1 networks such as Algorand, Avalanche, and Solana are also pushing the boundaries of performance and design, often integrating closely with Layer 0 and Layer 2 components.

For developers, infrastructure teams, and protocol designers, understanding where a solution sits in this layered model is increasingly important. It influences how you architect your system, how you manage trade-offs, and which parts of the stack you choose to operate yourself.

Set up your Web3 server in minutes

Optimize cost and performance with custom or pre-built dedicated bare metal servers for blockchain workloads. High uptime, instant 24/7 support, pay in crypto.